Introduction to NVDA Stock

NVIDIA Corporation (NVDA) stands as one of the leading players in the semiconductor industry, renowned for its innovative products and technologies. Founded in 1993, NVIDIA initially specialized in graphics processing units (GPUs) that cater to the gaming industry. Over time, the company’s portfolio has significantly expanded, positioning it as a pivotal entity in several burgeoning sectors, particularly gaming, data centers, and artificial intelligence (AI).

At the heart of nvda stock split impact lies its dominant presence in the gaming market. The company’s GPUs are integral to high-performance gaming experiences, allowing for immersive graphics and fluid gameplay. This segment has not only generated substantial revenue but has also played a crucial role in fostering a loyal customer base among gamers and eSports enthusiasts.

In addition to gaming, NVIDIA has successfully established itself in the data center space, a key area that has witnessed explosive growth in recent years. As organizations increasingly rely on cloud computing and data analytics, NVIDIA’s powerful GPUs are being utilized for deep learning and complex computational tasks. This trend underscores the company’s importance in advancing cloud infrastructures, making NVIDIA a vital partner for businesses aiming to harness the capabilities of AI and machine learning.

The advent of AI technologies represents another significant growth avenue for NVIDIA. As industries around the globe embrace AI for various applications, such as autonomous vehicles and intelligent systems, NVIDIA’s architecture provides a robust foundation for developing and deploying AI-driven solutions. This not only enhances the company’s market appeal but also solidifies its position at the forefront of technological advancement.

In summary, understanding NVDA stock requires an appreciation for its multifaceted business model that encompasses gaming, data centers, and AI technologies. As these sectors continue to evolve, NVIDIA remains a critical player in the tech stock market, offering investors promising potential within an increasingly digital landscape.

Historical Performance of NVDA Stock

NVIDIA Corporation (NVDA) has been a prominent player in the technology and semiconductor sectors, and its stock performance reflects its substantial growth and market influence. Over the years, NVDA stock has demonstrated a remarkable trajectory, influenced by various technological advancements and market dynamics. Historically, the stock was initially listed on the NASDAQ in 1999, showing modest growth in its early years. However, key moments, particularly the evolution of graphics processing technology and the expansion into artificial intelligence (AI), have significantly impacted its valuation.

One pivotal event in NVIDIA’s history occurred in 2017 when it experienced a surge driven by the rising demand for GPUs not only in gaming but also in data centers and AI applications. The company reported increasing revenues and profitability, leading to soaring stock prices that captured the attention of investors. It was during this period that NVDA solidified its position as a leader in the semiconductor industry, not just for gaming but for complex computing tasks that demanded high processing power.

In 2020 and 2021, NVIDIA’s performance continued to impress; the pandemic accelerated digital transformation across various industries. The increased reliance on cloud services and remote technologies led to an unprecedented rise in demand for NVIDIA’s products. As the company announced significant partnerships and strategic acquisitions, including Mellanox Technologies, stock prices reached historic highs.

More recently, market fluctuations and global economic conditions have resulted in variability in NVDA stock performance, but its long-term trajectory remains upward. Investors are closely monitoring the company’s developments in AI and machine learning, as these sectors hold great potential for further driving growth. Overall, NVDA’s historical performance highlights its ability to adapt and thrive in a rapidly changing technological landscape, establishing itself as a cornerstone of investment in the tech industry.

Factors Influencing NVDA Stock Price

The stock price of NVIDIA Corporation (NVDA) is influenced by a multitude of factors which can significantly affect investor decisions and market trends. Understanding these influences is essential for investors looking to navigate the complexities of the stock market. One of the most substantial factors is the overall market trend. A bull or bear market can lead to corresponding reactions in NVDA stock prices, as investor sentiment is often a critical driver in the stock market.

Investor sentiment, shaped by news and events surrounding the technology sector, has a direct impact on NVDA stock. Positive news about product launches, significant contracts, or advancements in artificial intelligence can enhance investor enthusiasm, leading to price increases. Conversely, negative news or economic downturns can trigger sell-offs, creating downward pressure on the stock price.

Technological advancements also play a pivotal role in the valuation of NVDA. As a leader in graphics processing units (GPUs) and artificial intelligence technologies, any innovation, product announcement, or technology breakthrough can substantially affect demand for NVDA stock. Furthermore, competition in the GPU space, primarily from companies such as AMD and Intel, can influence stock performance. A strong competitor announcement or improvement can lead to market volatility, impacting NVIDIA’s market position.

Economic indicators such as inflation rates, interest rates, and employment data are crucial determinants of investor confidence, which in turn can affect NVDA stock prices. Regulatory changes, especially concerning data privacy and technology standards, can also influence the company’s operational landscape, further complicating stock valuations. By closely monitoring these factors, investors can gain a more comprehensive view of what drives NVDA stock prices and make informed investment decisions.

Market Position and Competitive Analysis

NVIDIA (NVDA) occupies a prominent position in the semiconductor and technology industries, known primarily for its graphics processing units (GPUs) that cater to a diverse market including gaming, professional visualization, data centers, and automotive applications. Against this backdrop, it is important to evaluate NVIDIA’s competitive stance relative to its main rivals, particularly Advanced Micro Devices (AMD) and Intel.

To better comprehend NVIDIA’s market position, a SWOT analysis serves as a useful framework. Starting with strengths, NVDA boasts a robust reputation for high-performance graphics technology and a strong portfolio of patents, enabling it to maintain a technological edge. Furthermore, NVIDIA’s entry into artificial intelligence (AI) and machine learning applications has resulted in substantial business growth, diversifying its revenue streams.

However, the company also faces weaknesses, such as dependency on the cyclical nature of the semiconductor market and potential over-reliance on a few key products. The volatility in its profit margins, particularly in consumer-oriented segments, remains a concern that investors should monitor closely.

Opportunities for NVDA are abundant, particularly in the expanding sectors of cloud computing and AI-driven technologies. The increasing demand for GPUs in these areas positions NVIDIA favorably for growth. Moreover, strategic partnerships with firms focused on AI development could further enhance its market share.

Conversely, NVIDIA is not without threats. The competitive landscape, particularly from rivals such as AMD and Intel, is intensifying. AMD has gained significant market share with its Ryzen series of processors and Radeon GPUs, which offer compelling alternatives to NVIDIA’s offerings. Additionally, Intel’s efforts to advance its graphics products could pose a challenge to NVIDIA’s future sales.

In conclusion, while NVIDIA’s strong market position and innovative capabilities present significant advantages, the company must navigate various risks and competition in order to sustain long-term growth in a rapidly evolving tech environment.

NVDA Stock in the Investment Portfolio

The inclusion of NVDA stock in an investment portfolio serves a crucial role in achieving diversified asset allocation and managing overall investment risk. NVIDIA Corporation, recognized for its leadership in graphics processing units (GPUs) and AI technologies, has garnered considerable attention from investors and analysts alike. This stock’s performance is often linked to the growth of the tech sector, making it essential to assess how it complements other holdings within a portfolio.

Diversification is key to reducing risk; by holding a variety of investments, an investor can shield their portfolio against the volatility of any single stock. When considering NVDA stock, one must evaluate its correlation with other assets. For instance, technology stocks may exhibit high correlation with one another, while sectors like utilities or consumer staples may perform differently under specific market conditions. Therefore, incorporating NVDA can enhance growth potential while ensuring a balanced approach to risk.

Furthermore, risk assessment is fundamental when integrating NVDA into an investment strategy. This involves evaluating the stock’s historical volatility, market trends, and overall economic conditions. Investors should keep in mind that while NVDA stock has shown impressive gains, its past performance does not guarantee future results. Market fluctuations can impact individual stocks significantly, especially those in the technology sector, which are susceptible to rapid changes in consumer demand and regulatory scrutiny.

Ultimately, NVDA stock can play a valuable role in a well-rounded investment portfolio, particularly for those seeking exposure to cutting-edge technology and innovation. It is essential for investors to analyze their individual risk tolerance and investment goals before allocating a portion of their portfolio to NVDA. By doing so, they can ensure that this particular investment aligns with their broader objectives, aiding in achieving long-term financial success.

Future Growth Potential of NVDA Stock

As we analyze the future growth potential of NVIDIA Corporation (NVDA) stock, it is essential to consider various key factors such as market projections, anticipated product launches, and continual innovations in technology that are shaping the landscape of this industry. Industry analysts are bullish on NVDA, with many projecting a consistent upward trajectory for the company due to its innovative product offerings and strong market position.

One of the primary growth drivers for NVDA is its ongoing investment in artificial intelligence (AI) and machine learning technologies, which are increasingly becoming indispensable in various sectors. As industries continue to embrace AI to enhance efficiency and performance, NVIDIA stands to benefit significantly. Furthermore, upcoming product launches, such as advancements in graphics processing units (GPUs), particularly for gaming and data center applications, indicate a robust demand in these markets.

Additionally, NVIDIA has a strong foothold in the growing fields of autonomous vehicles and edge computing. The company’s partnerships with automotive manufacturers and tech firms position it well to capture a share of these emerging markets. Notably, experts forecast substantial growth in the autonomous vehicle sector, where robust demand for high-performance computing and AI capabilities will prevail.

Moreover, NVIDIA’s strategic acquisition of Arm Holdings could have transformative implications for its future, enhancing its ability to expand into new markets and leverage cutting-edge technologies. Analysts are keenly watching the implications of this acquisition on the company’s growth trajectory, especially given the escalating demand for chips in various electronic devices.

In conclusion, with a solid foundation in technological innovation and a strategic approach to market expansion, NVDA stock presents a noteworthy growth opportunity, backed by favorable market dynamics and expert predictions. Stakeholders should remain attuned to industry trends and company developments to fully understand the potential of NVIDIA in the coming years.

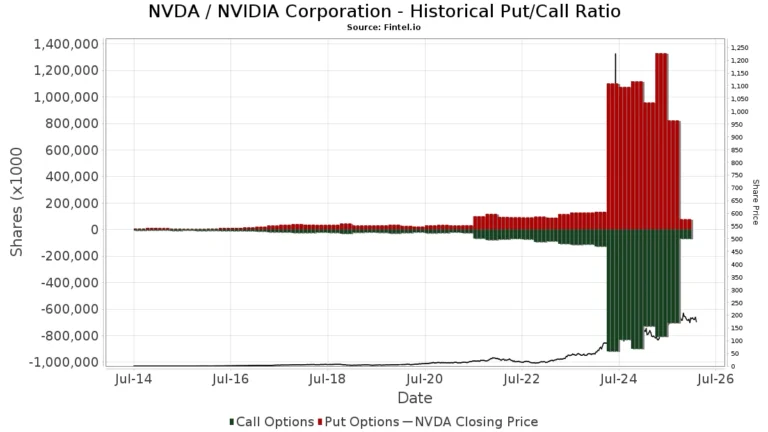

Technical Analysis of NVDA Stock

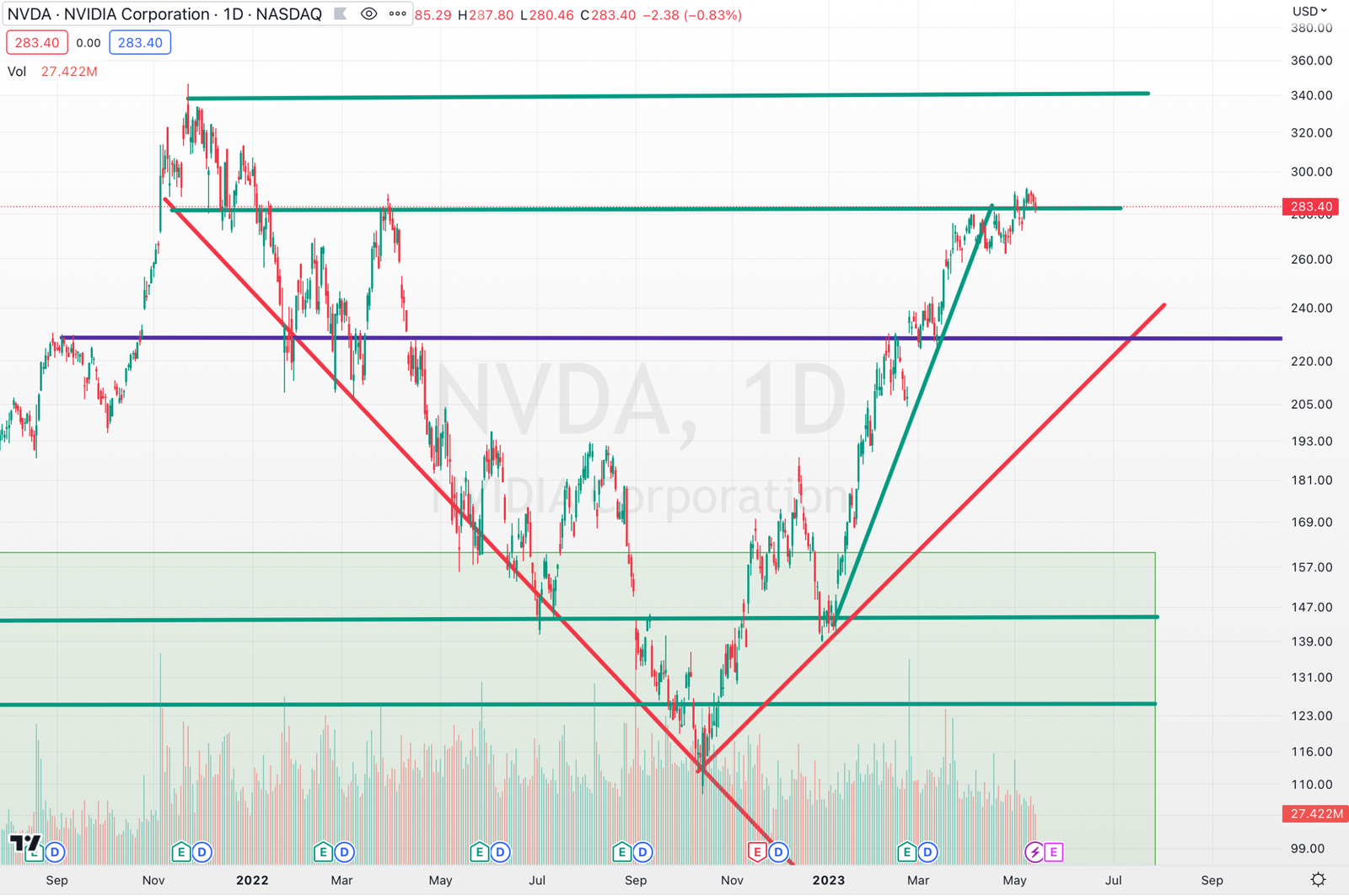

Technical analysis plays a crucial role in evaluating NVDA stock’s market performance, helping traders and investors make informed decisions. By using historical price data and volume trends, technical analysts identify patterns and formulate predictions about future movements in the stock price. A fundamental aspect of this approach is understanding support and resistance levels, which denote prices at which NVDA stock tends to stop and reverse direction.

Support levels indicate where buying interest emerges, forming a floor that prevents the stock from declining further. Conversely, resistance levels signify price points where selling pressure surfaces, creating a ceiling that cap future increases. Identifying these levels aids traders in recognizing potential entry and exit points, thereby optimizing their trading strategy.

Another key component of technical analysis is the use of moving averages, commonly applied to smooth out price action and identify current trends. The simple moving average (SMA) and the exponential moving average (EMA) are frequently utilized for NVDA stock. By analyzing these indicators over various time frames, traders can gauge the strength of a trend, determine potential reversals, and highlight cross-over points that signify buy or sell signals.

Additionally, traders often examine momentum indicators such as the Relative Strength Index (RSI) and Moving Average Convergence Divergence (MACD). The RSI helps assess whether NVDA stock is overbought or oversold, while the MACD generates buy and sell signals based on moving average crossovers. Collectively, these indicators provide insightful information that can affect trading decisions.

In conclusion, mastering technical analysis is essential for anyone interested in NVDA stock. With an understanding of key metrics, such as support and resistance levels, moving averages, and momentum indicators, investors can craft well-informed strategies to navigate fluctuations in the market effectively.

Investor Sentiment and Community Insights

Investor sentiment plays a pivotal role in the evaluation and volatility of NVDA stock, as it reflects the collective feelings of stakeholders regarding the company’s prospects and performance. Recent trends in social media platforms and investment forums indicate a strong affinity among retail investors towards NVIDIA Corporation, particularly due to advancements in artificial intelligence and gaming technology.

Social media conversations often highlight innovations by NVIDIA that resonate with investors. Platforms like Twitter and Reddit serve as vibrant arenas for discussions, where sentiments can shift rapidly. For instance, when NVIDIA released news about its latest product developments or partnerships, there were significant spikes in positive sentiment, which often translated into short-term stock gains. Conversely, negative news coverage, such as regulatory concerns or decreased earnings forecasts, can lead to abrupt declines in perceived value, illustrating the direct impact of public perception on stock volatility.

Investment forums provide a more detailed insight into retail investor concerns and expectations. Many investors actively engage in discussions regarding NVDA’s market performance, sharing strategies, projections, and fears, which can greatly influence trading behavior. Analysis from these communities suggests a tendency towards optimism, particularly in segments that focus on future growth areas, including data centers and advanced computing solutions.

Ultimately, investor sentiment regarding NVDA stock encapsulates a complex interplay between collective optimism and apprehension. This collective psyche not only drives market volatility but also informs crucial investment decisions. As the dynamics of investor sentiment evolve, stakeholders must remain vigilant, recognizing that the future performance of NVDA stock may heavily rely on the prevailing attitudes within its investment community.

Conclusion: Is NVDA Stock a Buy?

As we have explored throughout this analysis, NVDA stock split has demonstrated notable resilience and growth potential within the tech landscape, particularly in sectors influenced by artificial intelligence, gaming, and data centers. Historical performance reveals a strong upward trajectory, significantly outperforming many competitors in the semiconductor industry. Over the years, NVIDIA has not only expanded its market share but has also diversified its revenue streams, showcasing its adaptability to changing technological demands.

Market trends further bolster the optimistic outlook for NVDA stock. The increasing reliance on AI technologies and cloud computing solutions is driving demand for NVIDIA’s GPUs, which play a crucial role in processing complex algorithms. Additionally, governmental and corporate investments in technological innovation are likely to create an environment conducive to sustained growth for NVIDIA. With its strategic partnerships and innovative product pipeline, the company is well-positioned to capitalize on emerging trends.

While there are inherent risks associated with investing in technology stocks—particularly those that are growth-oriented like NVDA—analytics suggest that NVIDIA’s robust fundamentals and market positioning enable it to navigate potential challenges effectively. As the tech industry evolves, staying informed about macroeconomic indicators and sector-specific developments becomes paramount for investors.

Ultimately, for those evaluating whether NVDA stock represents a viable buying opportunity, the outlook appears promising based on both its historical performance and future growth strategies. Investors may find that NVDA’s potential for price appreciation aligns well with their long-term investment goals, making it a stock deserving consideration in diversified investment portfolios.